The presidency isn’t the only position up for election in November. National, state, and local positions are on the ballot as well. To accomplish what the president wants, he needs the support of some of these officials. Without that support, we oftentimes have gridlock, where nothing seems to get accomplished politically on the national level. Gridlock is frustrating and seems inefficient, so it would make sense that stock market returns would be worse under a divided government, where different political parties control the presidency and one or both houses of Congress.

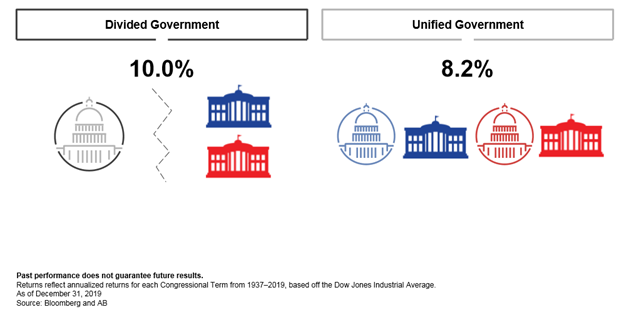

History tells a different story though, as the stock market has performed well under both divided and unified governments. In fact, as the chart below shows, average stock market returns are actually higher in years of divided government!

Oftentimes, the checks and balances of a divided government keep both sides from implementing an extreme agenda. A government with both party views also encourages bipartisanship and compromise, which can promote solutions that benefit a wider range of citizens, and a stronger economy. Although gridlock is frustrating, history proves that the effect on the stock market is a healthy one.