Ten years ago, on March 9, 2009, Modus Advisors opened its doors in Eden Prairie, MN. It was an inauspicious day to start a company, particularly in the financial services industry. The stock market, as measured by the S&P 500, had fallen 56.8% from its peak on October 9, 2007. What came to be

Q2 2018 Market Update

Market Update 2017 was a period when nearly everything worked for investors. This was most decidedly NOT the case for the first half of 2018. Indexes representing international equities, emerging markets, fixed income, and U.S. value stocks were all down between -2% and -7% for the first half of

Not So Small!

You may have heard that this week is National Small Business Week. The technical definition of a Small Business is an independent business with fewer than 500 employees, but I certainly think of businesses on the low end of that range when I hear the term. In 2013, 48% of the workforce was employed

The Glass is Half Full

Eight years ago to the day, March 9th, 2009, we opened our doors at Modus Advisors. In many respects, it was the absolute worst time to start an investment services and wealth planning business. The Dow Jones Industrial Average (DJIA) peaked on

Where Do You Get Energy?

One of the hardest things in the politicized world we live in is to find unbiased information. I’m a Certified Financial Planner®, and about the farthest thing from a scientist or a physicist. When the topic of energy comes up, I’d love to be more informed, but the subject has generally been

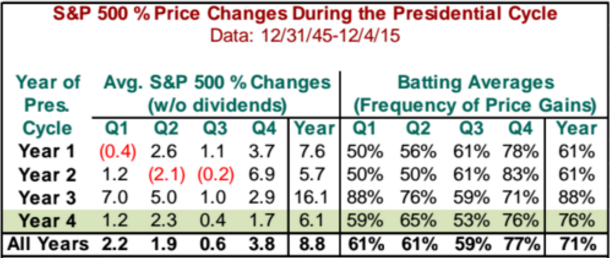

How do Presidential Elections Affect Markets?

Every four years we as citizens of America march to the ballot box to elect our next president. It’s arguably the greatest civil duty we possess as everyday Americans. Had our founding fathers known the wonderful personalities that the democratic process could create, however, I think they might

Investing in The Stock Market is like Playing the Lottery!?

To many people, investing in the stock market is akin to playing the lottery. To these people, the stock market is rigged, and only the insiders or the big institutions have the ability to consistently make money in stocks. According to Gallup, the numbers bear this out.* In the spring of 2016,

I’ve Projected Your Retirement and It Looks Great! But Wait…

“You’re on track to a healthy retirement.” “You need to increase your contribution to meet your retirement income needs.” At one time or another you’ve probably seen quotes like these either on your 401(k) website or after looking at a retirement income calculator. The quote was likely accompanied

The Reasons Not to Invest

I was cleaning out some files recently when I came across a 1992 Investors Guide from The American Funds Group. The 20 page brochure was in mint condition, having been buried in a file for many years. As I flipped through the pages, I came across a chart that is called “The Reasons Not to Invest”