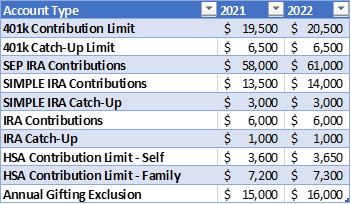

Happy New Year! A new year brings with it new limits for contributions and savings. Many of the figures this year are updated. This article highlights the federal contribution limits of which to be aware as you enter this new year.

Qualified Plans:

For qualified plans, such as 401(k)s and 403(b)s, the annual contribution limit increases from $19,500 in 2021 to $20,500 in 2022 for people under age 50. The IRS allows those over 50 years of age to contribute an additional $6,500 to their accounts, a “catch-up” limit unchanged from 2021. Therefore, employees 50 or older may contribute an annual maximum of $27,000 to their qualified retirement accounts in 2022, up from $26,000 in 2021.

A self-employed business owner with a SEP IRA can save the lesser of 25% of compensation or $61,000 in 2022, up from $58,000 in 2021. Catch-up contributions are not allowed in SEP IRAs.

SIMPLE IRAs:

Plan participants can defer as much as $14,000 in 2022 (up from $13,500 in 2021). The annual catch-up of $3,000 remains the same for those 50+.

Individual Retirement Accounts (IRAs):

Unchanged from 2021, one may contribute $6,000 to either a Traditional IRA or a Roth IRA. Also unaffected is the catch-up bonus available to those age 50+ of $1,000 for a total deferral amount of $7,000.

Health Savings Accounts (HSAs):

One may contribute $3,650 to an individual HSA plan and $7,300 to a family HSA plan for 2022. That represents a slight increase from 2021 when one could contribute $3,600 to an individual HSA in 2021 and $7,200 to a family plan.

Annual Gifting Exclusion:

In 2021, a person could gift $15,000 tax-free without using the lifetime gift and estate tax exemption. In 2022, this annual gifting exclusion increases to $16,000.

This list represents some of the federal limits for planning in 2022. Give us a call at Modus Advisors if you have any questions on how these changes affect your personal situation.