1Q21 Update

Market Update

What a difference a year makes! It’s hard to believe that, exactly one year from its low on March 23, 2020, the S&P 500 was up a staggering 81%. Over the course of the past 12 months, we’ve gone from virus to vaccine. From shutdowns to reopenings. From fear to hope. From recession to recovery. Americans don’t agree on much these days, but I think we can all agree that we can see the light at the end of this dark, dark pandemic tunnel.

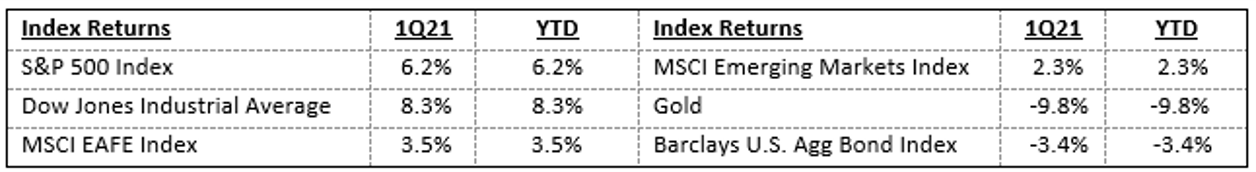

All this hopefulness drove another strong advance in global equities over the first quarter with the U.S. leading the way. But, after the long string of months where speculative growth equities (think Zoom, Etsy, Roku, etc.) lead the recovery, we finally saw a change in leadership during 1Q21: the Russell 1000 Value Index returned 11.4% while the corresponding Growth Index was barely positive at 1.1%. The highly successful vaccine rollout gave a boost to many of the unloved sectors of the market on the hopes of a robust recovery. Forgotten sectors like energy, financials, and industrials led the way after lagging for years while richly-valued growth stocks faded – at least for the time being. Likewise, small-cap companies finally caught a bid as investors know these stocks are most closely tied to the strength of the U.S. economy. Dividend payers in general also saw a nice first quarter rally.

In the world of bonds, the picture was not so rosy. Fears of an economy heating up too fast caused inflation worries to enter the discussion. While the Fed repeatedly stressed it would be slow to move rates higher, the realities of trillions of dollars of stimulus being pumped into our economy, sharp increases in demand from consumers ready to spend, and rising wages and input prices caused longer-term interest rates to swiftly rise during the quarter. This resulted in the worst quarterly performance for the Barclays U.S. Aggregate Bond Index (down 3.4%) in nearly 40 years when the index was down 4% in the third quarter of 1981.

Lastly, no summary of the first quarter would be complete without making mention of the crypto/NFT/GameStop craziness. We saw the price of Bitcoin more than double over the first three months of the year, going from about $30k to more than $60k in March. The price of Ethereum (the second most widely-held cryptocurrency) also doubled, going from about $750 at the beginning of the year to over $2,000 in February (and, it’s knocking on $3,000 as I write this letter). NFTs (Non-Fungible Tokens) were certainly not a part of our lexicon until early this year. Now, folks are paying millions for the right to say they own the original image or clip of some digital asset. Throw in the madness surrounding the head-spinning rally in GameStop (a mall-based video game retailer on the verge of extinction) spurred on by young disrupters on online message boards, and we’re left with an unforgettable quarter.

Portfolio Update

Overall, our clients’ portfolios experienced a nice start to the year. As everyone has a healthy balance of both growth and value equities, the value component kicked into gear over the past few months, picking up the slack from slumping performance in the growth space. Also helping overall performance was our stance in the non-equity portion of our portfolios. Given the persistent very low interest rates, we have been using various “alternative” strategies to complement our core fixed income investments. These strategies, like merger arbitrage and options arbitrage, were positive for the quarter while bond positions lost value.

Within our diversified portfolios, our positions in a financials ETF, an industrials ETF, and small-cap index exposure were the largest gainers. For those clients who hold the Modus Dividend portfolio, the biggest gainers were: Caterpillar +27%, Target +12%, and JPMorgan +21%. The biggest detractor was Apple -8%. For those clients who hold the Modus Best Ideas portfolio, your biggest gainers included Blackstone +17%, Google +18%, and Ulta Beauty +6%. Detractors included Amazon -5%, Palo Alto -9%, and Lululemon -11%.

Another item of interest that happened over the first quarter was our firm’s foray into the cryptocurrency space. Over the past few years, we have often fielded questions on the merits of Bitcoin or other cryptocurrencies, but brushed them aside believing it was too speculative, too early, and too unproven. In the second half of 2020, we decided to take a closer look at the burgeoning asset class as it seemed to be gaining in acceptance and becoming more mainstream. In the end, we decided it makes sense for the right clients to have a small exposure (about 1%) to this digital asset given recent corporate adoption, its finite supply, and its potential to fundamentally alter how the world transacts.

We explored and interviewed various prospective crypto partners as holding crypto directly with Schwab is not possible. After our due diligence, we decided to partner with Gemini – one of the market leaders in cryptocurrency trading and custody. And, as is always the case with investment recommendations we make to our clients, Tad and I made the first allocations with our own capital, testing the security, the ability to marry our reporting systems with those of Gemini, and the trading mechanics involved. We are extremely pleased with the partnership and are happy to be able to offer direct exposure to Bitcoin and Ethereum for clients wanting a more meaningful stake.

In addition to these direct holdings at Gemini, in late-February, we took advantage of a steep drop in the price of a publicly traded Bitcoin security to add 1% to the tax-deferred accounts of our clients with moderate- to aggressive-risk profiles. Rather than have 5% of your diversified portfolios exposed to gold, we elected to divert 1% to the Grayscale Bitcoin Trust (GBTC), leaving 4% in gold. We view this as a long-term hold for these clients, offering what we believe could be an attractive hedge against inflation and the potential for significant price appreciation. So far, this move has worked out nicely. While gold lost nearly 10% in the first quarter, our clients’ GBTC holding was up nearly 12%.

Modus is most definitely on the leading edge of advisors incorporating cryptocurrencies as a small portion of a diversified portfolio. We will be discussing this with you and addressing any questions you may have during your next Modus review meeting, but please feel free to reach out if you have questions in the meantime.

Taxes

By far, the most frequent question we have been getting over the past few months concerns taxes. While it shouldn’t be a surprise to anyone that a tax increase would accompany any major new stimulus measures coming out of D.C., the latest announcement of a proposed increase to the capital gains rate and the potential elimination in the step-up in basis upon death have some folks on edge.

Before panicking, however, it’s crucial to remember that this latest proposal is just that – a starting proposal. With the very slimmest of margins in the Senate, it is highly unlikely that anything close to this initial proposal will eventually pass. First up, the proposed American Jobs Plan and the American Families Plan need to go through Congress’s sausage factory in order to come up with bipartisan bills that can actually become passed legislation. Any components that call for significant tax increases will be a very tough sell and will likely take months to hammer out. While we could be wrong, our best guess is that these changes won’t take effect until 2022.

When it’s all said and done, we think that those making less than $400k/yr will be immune from tax hikes. It’s most likely that the top individual income tax rate will bump back up to 39.6% from the current 37%. For those in the $1 million and above income bracket, there will likely be a hike of some kind for income derived from investments (capital gains and dividends) but we think it will likely be something less than initially proposed. Know we are watching this closely and will be incorporating the new rates into all planning. If the hikes take effect Jan 1, 2022, it may make sense to harvest significant gains at current rates in 2021. Or, we may elect to hold off taking gains until a lower-income year. Or, we might encourage some to take full advantage of your annual gifting allotment. Or, we may choose to sit tight and wait for the inevitable change that will happen with some administration down the road. No matter what, know that any gains we take now or in the years to come will be made only after a thoughtful assessment of your entire, unique financial picture.

Finally, it bears repeating that an increase in taxes, historically, has been good for equity returns.

- U.S. equities have had their highest gains during years in which personal tax rates rose. This is likely because tax increases tend to be accompanied by increased fiscal spending.

- We tend to see higher corporate investment (new equipment, factories, etc.) when corporate taxes increase, as many would rather reinvest profits rather than pay taxes. This reinvestment can often spur future growth.

- While past performance is no guarantee of future results, according to Bloomberg, the S&P 500 has returned:

-

- 9% from 1950 to 2020

- 11% during years when capital gains rates increased

- 13% during years when corporate tax rates increased

- 14% during years when personal tax rates increased

-

Outlook

Are we in the beginning stages of what many are referring to as the new Roaring 20s? It’s possible. There are certainly many reasons to be cautiously optimistic about the near-term. With the CDC reporting over 240 million shots in arms and that more than 1/3 of the population is fully vaccinated, Americans are ready to get back to it! Savings rates are near record levels, and we are ready to spend that money – travel, entertainment, clothes, home improvement, beauty, etc. That spending, together with the trillions in stimulus and low interest rates, will be rocket fuel for the economic recovery. If this happens, strong earnings will allow companies to grow into their currently-lofty valuations.

We see two main risks to this Goldilocks recovery story. The first is an overheating economy. Given today’s landscape, inflation is inevitable. In a perfect world, the playbook has us running over the 2% inflation target, but only temporarily as bottlenecks due to pandemic shutdowns start to clear. There will be problems, however, if we significantly overshoot the inflation targets on a sustained basis. If this occurs, the Fed will be forced to step in by raising interest rates in an effort to cool things down. Higher interest rates make borrowing more expensive which often puts a damper on capital spending. This, in turn, often results in lower economic growth. The second main risk to the recovery is COVID variants. As long as a significant number of hosts for the virus remain, the risk of a vaccine-resistant mutation developing is a concern. Keeping the virus at bay and protecting the most vulnerable is absolutely key to keeping this economic recovery going; another COVID wave would almost certainly derail the progress we have made.

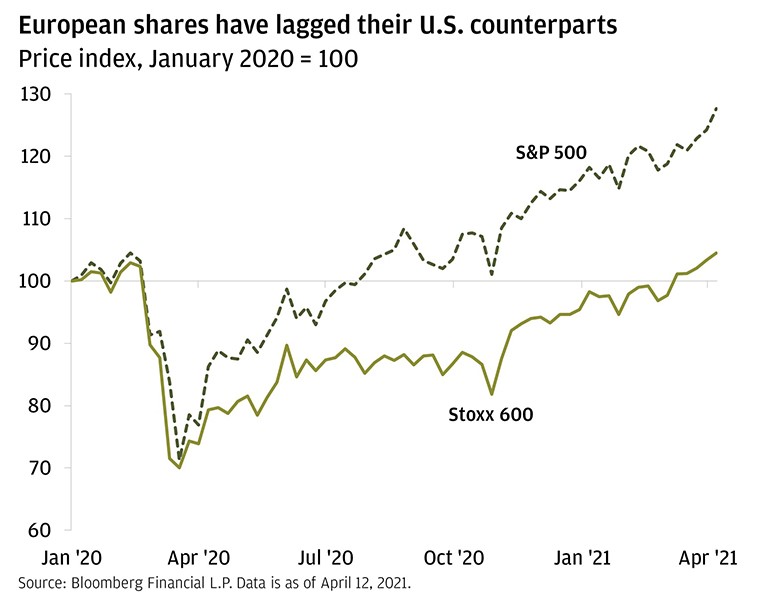

We remain hopeful that between vaccinations and prior infections, the reopening of our economy will be very successful. And, while we are certainly keeping a keen eye on inflation numbers, we continue to maintain a fully invested stance with a bias toward equities over fixed income as economic growth favors stocks over bonds. As value investing tends to outperform in an environment of strong economic growth and higher inflationary expectations, we will continue to trim growth equities in favor of value. Additionally, we see opportunities developing outside the U.S. as their vaccine rollouts catch up. Specifically, there is a significant price discrepancy between U.S. stocks and their European counterparts:

In summary, look for a little more value stocks, and a fewer growth stocks. Look for an increase in international exposure. Look for high quality, low-duration fixed income. Expect some hiccups along the way, and, most importantly, expect your portfolio to remain highly diversified, as we view this as the best hedge against whatever surprises come down the pike.

In-Person Meetings

While we’ve all become Zoom experts, and it was great to have that technology so we could continue our regular update meetings, we have really missed seeing each of you in person. Face-to-face meetings are just different, and better, and we’ve missed having them. We are delighted to announce that all seven of us in the Modus team have had their two vaccination jabs and are feeling great! Know that when you are ready to venture out again, we are here waiting for you with a tasty drink, an elbow bump, and a return to normal. And, for those of you who have enjoyed the freedom of not having to drive out to Excelsior, remote meetings will forever be an option.

Happy Spring to you all!

Kari Haanstad

Chief Investment Officer

Please note:

* Investments used by Modus Advisors including debt, equity, commodities, real estate, alternative investments, cryptocurrencies, mutual funds, and ETFs are speculative and involve a substantial degree of risk. While there is the potential for profit, there is also the possibility of loss.

* The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

* Past performance of various public indexes discussed in this presentation were gathered from Morningstar.

* The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Investing in stocks is subject to fluctuation such that, upon sale, shares may be worth more or less than the original cost.

* International and emerging market investing involves special risks such as currency fluctuation and political stability and may not be suitable for all investors.

* Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

* There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not ensure against market risk.

Index Definitions:

The S&P 500 Index is an unmanaged index comprised of 500 stocks of large U.S. companies, representing many industries. It is a common measure of the performance of the overall U.S. stock market.

The Dow Jones Industrial Average is comprised of 30 stocks that are major factors in their industries, and widely held by individuals and institutional investors. These 30 stocks represent about a fifth of the total market value of all U.S. stocks.

The MSCI EAFE® Index (Europe, Australasia, Far East) is a free float-adjusted market-capitalization index that is designed to measure developed-market equity performance, excluding the U.S. and Canada.

The Barclays U.S. Aggregate Bond Index is composed of the Mortgage-Backed Securities Index, the Asset-Backed Securities Index and the Government/Corporate Bond Index. It is a broad measure of the performance of taxable bonds in the U.S. market, with maturities of at least one year.

The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

The MSCI Emerging Markets Index captures large and mid cap representation across 23 Emerging Markets (EM) countries*. With 833 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

NOTES: * Indexes are unmanaged, and it is not possible to invest directly in an index.

* All performance referenced is historical and is no guarantee of future results.

* Return data for MSCI EAFE Index and MSCI Emerging Markets Index is from www.msci.com.