The S&P 500 reached 3,386 at its peak on February 19th, 2020, before its month-long decline to 2,237 on March 23rd. From February to March, the S&P decreased by 34%. After that trough in late March, the S&P rose 30% by April 30th. At first glace, one might think that the gains made in April nearly cancel out the March losses. However, looking at the S&P value reported in April reveals that this is not the case. On April 30th, the S&P was valued at 2,912. Overall, the S&P was still down 14% from its peak in February. This example shows that, unfortunately, losses have a larger impact on a portfolio than equal gains. Gains must exceed losses to break even in a portfolio. A 20% loss in a portfolio requires a 25% gain to be made whole.

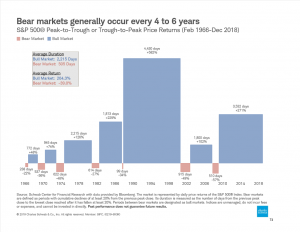

While recessions always seem unfortunate, the attached chart shows that there is some redeeming news. As displayed in the chart, climbing bull markets, shown in blue, have historically run far longer than declining bear markets in red. Bull markets run, on average, about four times as long as bear markets. Moreover, the magnitude of these bull markets far outweighs that of bear markets. An average bull market yields a return over five times the magnitude of a corresponding decline of a bear market. While bear markets are scary and uncertain as they occur, history shows that the US economy generally trends upward, in spite of these occasional setbacks of declining bear markets.

While gains need to be of greater magnitude to make up for past portfolio losses, history shows that past bull markets are longer and of greater magnitude than past bear markets. While it is difficult, if not impossible, to foresee these market corrections, this graph justifies the need to stay invested during times of uncertainty. Modus advocates a diversified portfolio to protect during times of decline. Furthermore, we continually analyze current and potential portfolio investments in order to be in an even better position when the recovery does come, as historical recoveries always have. At that time, we will attempt to be positioned to take advantage of a rising market. Please don’t hesitate to contact us at Modus Advisors if we can be of assistance to you or answer any of your questions during this time of uncertainty.

Maggie Swanson

Client Relationship Manager