3Q20 Update

Market Update

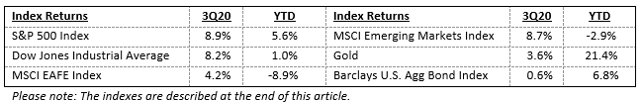

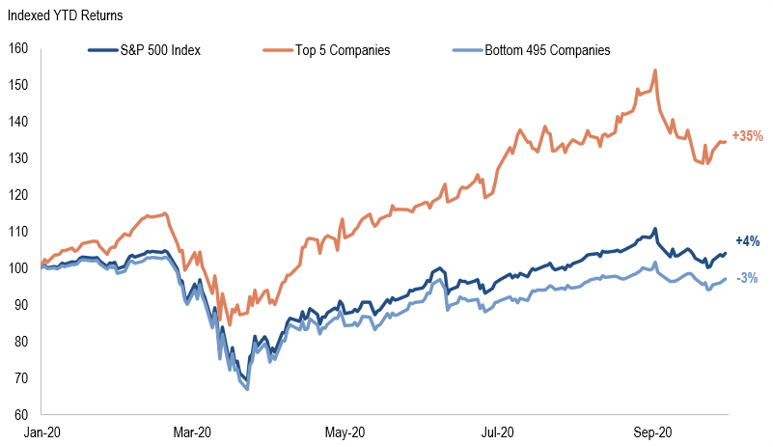

In a year chock full of “unprecedenteds” and “historics” and “never befores,” another one of those history-making moments of 2020 quietly happened during the third quarter. Despite the ongoing pandemic, continued high unemployment, mostly deserted downtown office towers, and the fact most of our social lives are essentially on pause, on August 18 we were officially able to say we are in a bull market. On that date, the S&P 500 surpassed its prior high from February 19th, which officially put an end to what we now know to be a record-breaking, unprecedented, historic bear market. At only 33 days, it was breathtakingly severe and short, but as soon as the market hit the level of February’s prior high, we could officially mark the beginning of this current bull market as March 23 (the lowest point reached). As crazy as this seems, it means we are now over seven months into this current bull market – a bull market that began when we were at peak COVID-19 despair and uncertainty.

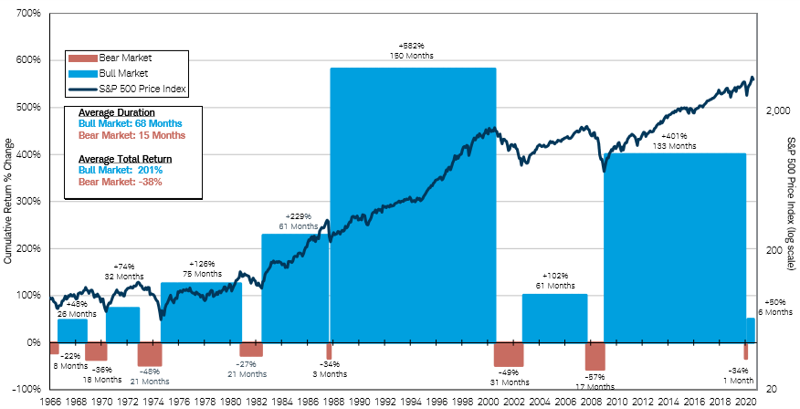

So, yes, as a whole, the 500 stocks that make up the S&P 500 index have had an extraordinary, 50+% run off their March lows, but there is a twist to this story. The largest five stocks in the index (Apple, Microsoft, Amazon, Facebook, and Alphabet) are nearly single-handedly responsible for this recovery. Specifically, the S&P 500 index is up +4% for the year (+5.6% when one includes dividends paid). But when we break that performance down between the largest five companies and the remaining 495, we see strikingly different results. Those top five stocks are up a collective +35% for the first nine months of the year, whereas the remaining 496 are down -3%. As a result of this performance diversion, those five stocks have grown to account for nearly 25% of the total index. Never before have we seen this sort of concentration in what is typically viewed as a diversified large-cap index. So, yes, we are in a bull market, albeit a bull market for a few fortunate companies (namely U.S. large cap growth equities).

These two graphs illustrate the points above, specifically: 1) how the recent bear and current bull markets compare to history, and 2) the performance dispersion we have seen in 2020.

Source: Bloomberg as of 9/30/2020. Bull and Bear Markets as defined by Yardeni Research. Indexes are unmanaged, do not incur fee or expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

Source: Bloomberg and GSAM as of September 30, 2020. Chart shows the year to date performance of the S&P 500 Index, the 5 largest companies in the S&P 500 on a market capitalization weighted basis (Apple, Microsoft, Amazon, Facebook, and Alphabet), and the rest of the index. Past performance does not guarantee future results, which may vary.

Portfolio Update

In prior communications, we had been able to tell you how our three main strategies (Conservative, Balanced, and Growth) performed over the reporting period. However, throughout this year, we have been busy revamping the portfolios in favor of a more customized approach. What this means is that rather than three main strategies, we now have many, each one based on factors like the investor’s risk appetite, account size, and time horizon, to name a few. You can track your specific accounts through schwaballiance.com, through your regular in-person Modus reviews, and of course, you can always give us a ring anytime and we can give you up-to-date performance information.

Broadly speaking, most of our investments were quite positive for the quarter. Large cap growth led the way again, but value equities started to show a little life after lagging for so long. Our industrial sector position paid off nicely during the quarter – we added industrials after the first round of stimulus, thinking that the next rounds may have some nice infrastructure incentives to help get the economy fired up again. Gold, emerging markets, fixed income all held their own, too, contributing to a nice quarter.

We manage two stock portfolios and both performed quite well over 3Q20. Before this year, we had used these individual stock holdings in just a small portion of our larger accounts. However, since Schwab instituted free trades, it made sense to deploy these across more of our accounts. Both of these portfolios have solid, multi-year track records and are the most cost-effective way for our clients to get equity exposure. Our Modus Best Ideas Portfolio (12 stocks that are often more growth-oriented) was up approximately +15% for the quarter and +19% for the year as of September 30. Our Modus Dividend Portfolio (12 high-quality dividend paying stocks) delivered approximately +12% for the quarter and about +5.5% for the first three quarters of 2020. Please note: Individual results will vary based on timing of investment, weightings of the underlying stocks, and fee schedules.

After the success of those two portfolios, we are excited to be launching a third equity portfolio on November 1. We have had several clients express interest in investing more “sustainably.” To that end, we are launching Modus ESG (Environmental, Social, Governance) where all equities purchased for this portfolio will have a record of “doing good” for our planet and its people. It is our hope we can deliver this exposure without sacrificing returns. If you have interest in incorporating this strategy into your portfolio, please let your advisor know.

The Election

No update would be complete without a discussion of the elephant (and donkey) in the room. We are days away from November 3, after which (hopefully not too long thereafter) our collective election nightmare will be over and there will be a declared winner. We hear over and over the concern many of you have for the outlook of your investment portfolios, your taxes, and your retirements based on your view of who’s best for the job. While it is true that markets do not like uncertainty, and uncertainty is what we have in spades right now, it behooves us to look beyond the heated rhetoric in the days and weeks surrounding an election and remember some critical facts for the long-term:

- Historically, U.S. equities have trended up similarly, regardless of whether a Democrat or Republican occupied the White House.

- From 1965 – 2019, the S&P 500 has returned 9.2% during the periods when a Democrat held the presidency, and 9.1% while a Republican held office.

- The one clear, winning investment strategy isn’t timing an investment to a particular political party, it’s staying invested through them all. Time invested is your friend, timing is not.

- While they change with each election cycle, uncertainty and controversy surround each and every campaign. Nevertheless, markets remain resilient over time.

- Presidents are not as influential in the economy as many believe. Investment success depends more on the strength and resilience of our economy than on which party holds office.

- An increase in taxes, historically, has been good for equity returns.

- U.S. equities have had their highest gains during years in which personal tax rates rose. This is likely because tax increases tend to be accompanied by increased fiscal spending.

- We tend to see higher corporate investment (new equipment, factories, etc.) when corporate taxes increase, as many would rather reinvest profits rather than pay taxes. This reinvestment can often spur future growth and increase odds of a robust recovery.

- While past performance is no guarantee of future results, the S&P 500 has returned, annualized:

- 9% from 1950 to 2019

- 11% during years when capital gains rates increased

- 13% during years when corporate tax rates increased

- 14% during years when personal tax rates increased

- While past performance is no guarantee of future results, the S&P 500 has returned, annualized:

Outlook

We are closing out the year with our clients fully invested – for some, that may mean 20% equity exposure; for others, 100%; for most, something in between. We know the chance of increased volatility over the next several weeks is high, but we feel odds are in our favor for a continued rally once the political uncertainty is behind us. Both candidates and Congress will have high incentive to get additional stimulus out to those who need it most. This cash influx, together with strong advancements in COVID vaccines and therapeutics, should provide some much need fuel to keep the bull market running. Other factors that point to future market strength include stock analysts’ rising earnings estimates and the fact that interest rates are expected to remain near zero until at least 2022. With rates at these levels, investors have few options other than stocks as they look to deploy assets.

We are also thinking and planning ahead in the event some meaningful tax changes look likely. Taking outsized long-term gains, Roth conversions, and other strategies may end up making sense for many of our clients. We will be in touch over the next many weeks if we believe you should take specific actions before December 31. And, of course, if you’d like to reach out with any specific questions you may have, we hope you’ll give us a ring or drop us a line.

We wish each of you good health, good health, and good health as we wrap up this year we will never forget. Of course, we’ve all been touched by COVID-19, but we are so thankful that our hundreds of clients and our families and friends have been spared the worst. We pray it stays this way.

Let’s be safe, take care of ourselves and each other, and vote!

Kari Haanstad

Chief Investment Officer

Please note:

* Investments used by Modus Advisors including debt, equity, commodities, real estate, alternative investments, mutual funds, and ETFs are speculative and involve a substantial degree of risk. While there is the potential for profit, there is also the possibility of loss.

* The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

* Past performance of various public indexes discussed in this presentation were gathered from Morningstar.

* Modus Net Returns are an average of a sampling of actual client portfolios employing the same strategy after all advisory fees, trading fees, and all underlying investment expenses have been deducted. Individual investors’ actual returns will vary based on timing of investment, weightings in the underlying investments, reinvestment of dividends, and fee schedule.

* The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Investing in stocks is subject to fluctuation such that, upon sale, shares may be worth more or less than the original cost.

* International and emerging market investing involves special risks such as currency fluctuation and political stability and may not be suitable for all investors.

* Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

* There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not ensure against market risk.

Index Definitions:

The S&P 500 Index is an unmanaged index comprised of 500 stocks of large U.S. companies, representing many industries. It is a common measure of the performance of the overall U.S. stock market.

The Dow Jones Industrial Average is comprised of 30 stocks that are major factors in their industries, and widely held by individuals and institutional investors. These 30 stocks represent about a fifth of the total market value of all U.S. stocks.

The MSCI EAFE® Index (Europe, Australasia, Far East) is a free float-adjusted market-capitalization index that is designed to measure developed-market equity performance, excluding the U.S. and Canada.

The Barclays U.S. Aggregate Bond Index is composed of the Mortgage-Backed Securities Index, the Asset-Backed Securities Index and the Government/Corporate Bond Index. It is a broad measure of the performance of taxable bonds in the U.S. market, with maturities of at least one year.

The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

The MSCI Emerging Markets Index captures large and mid cap representation across 23 Emerging Markets (EM) countries*. With 833 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

NOTES: * Indexes are unmanaged, and it is not possible to invest directly in an index.

* All performance referenced is historical and is no guarantee of future results.

* Return data for MSCI EAFE Index and MSCI Emerging Markets Index is from www.msci.com.